Solutions - Integrated Risk Management

Integrated risk management

Monitor Plus GRC-ORM™ (Governance, Risk & Compliance - Opportunities and Risk Manager)

is an automation solution to manage risks, vulnerabilities and opportunities.

Use cases

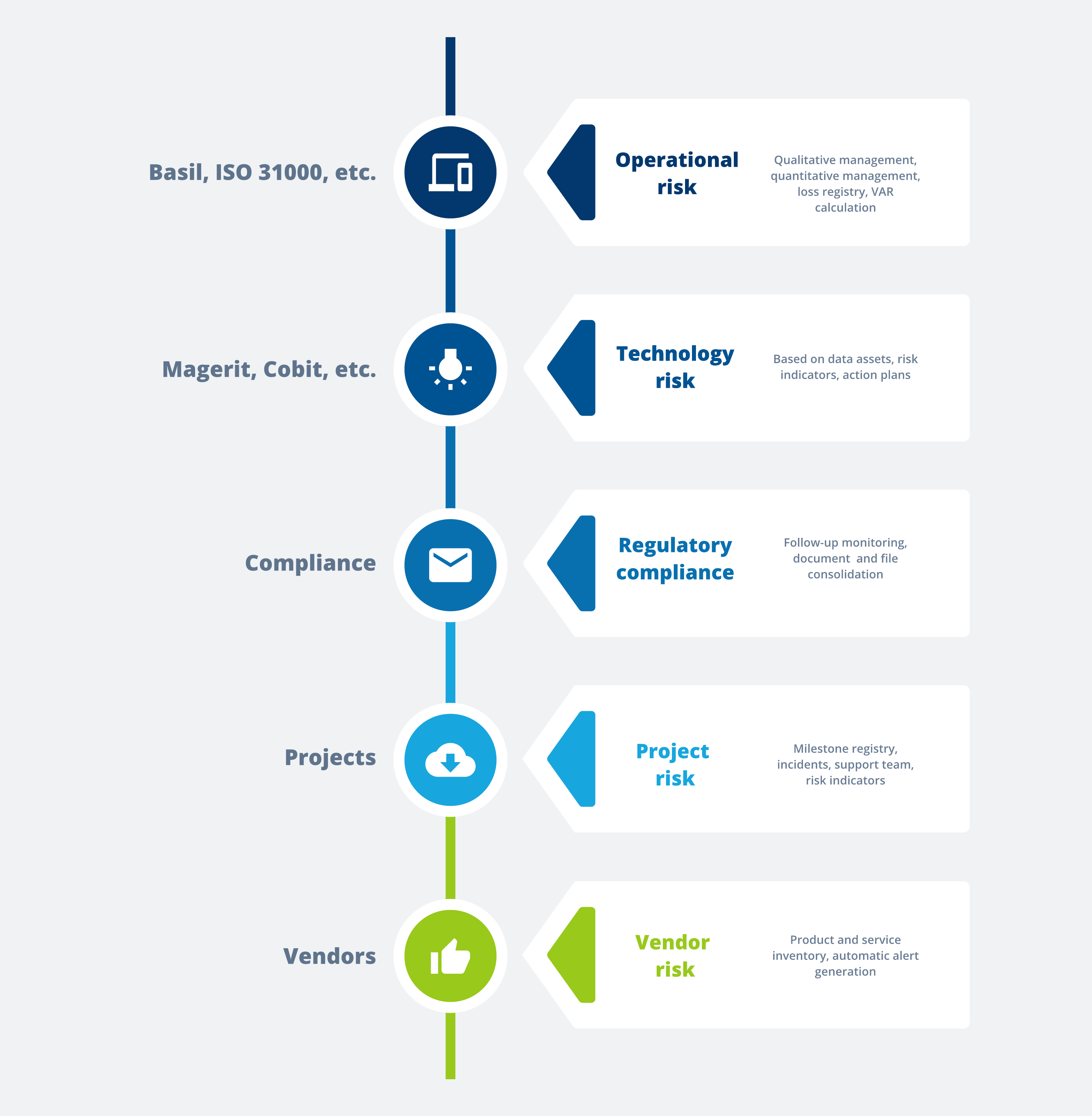

- Operational risk management and Value at Risk (VAR) calculation

- Technological risk

- Compliance risk

- Project risk

- Supplier risk

- Risk-based approach

- Quality management risk

MAIN BENEFITS

Comprehensive and automated management of multiple types of risk

Monitor Plus GRC-ORM™ (Governance, Risk & Compliance - Opportunities & Risk Manager) automates the management of multiple types of risk, vulnerabilities and opportunities. The system covers the entire risk and opportunity cycle and assists in automating the documentation of incidents and loss events in organizations.

Control and reduction of losses

This system facilitates detection, control and reduction of risks and the calculation of KRIs and KPIs. This allows the institution to define risk thresholds and tolerance limits to help prevent the occurrence of events and to execute automated mitigation plans in a timely if should they materialize.

Preventing failures and root causes of risks, threats or vulnerabilities

The system automates risk management and controls for business processes, assisting in the implementation of international risk management standards and related regulatory compliance in multiple countries.

Growth, innovation and support for new product launches

Monitor Plus GRC-ORM™ provides comprehensive risk insights in different areas of the institution that facilitate prevention, reaction, and timely mitigation.

Comprehensive, efficient and simple

RISK MANAGEMENT

Monitor Plus GRC-ORM™ helps organizations improve internal control practices to comply with policies and regulations (internal, local a,nd international). The system covers the entire risk and opportunity cycle (identification, analysis, classification, measurement, prioritization, control, mitigation and evaluation).

The system facilitates qualitative and quantitative risk management for individual or multiple companies, correlating events in real time with other Monitor Plus® modules.

Streamlined management of multiples types of risk for

LOSS REDUCTION

Synchronized multi-user integration for

different types of risks and all their processes

Deep business impact

- Optimization of risk management: creation and management of risk and performance indicators (KRIs and KPIs).

- Detection, analysis and control of multiple types of risk.

- Diagramming and documentation of processes in different areas of the institution.

- Risk, vulnerability and opportunity mapping.

- Early detection of risks to prevent failures and other root causes.

- Action plan monitoring automation to implement mitigation measures (controls).

- Enables a robust and reliable historical data record to calculate and model capital using a risk-based approach.

- Creation of self-assessment questionnaires for risk detection and rating.

- Collection of financial and non-financial loss events and incidents.

- Generation of timely alerts established by criteria according to the institution's needs.

- VAR management for operational risk.