Solutions - AML Compliance

Anti-corruption and bribery for the private sector

Monitor Plus ABC™ (Anti-Bribery & Corruption Manager)

is a solution that enables continuous real-time analysis to detect operations that pose a risk of bribery and corruption for the institution.

Use cases

- Mitigation of corruption and bribery risk.

- Detection of suspicious transactions.

- Detection of non-compliance with institutional policies and anti-corruption programs.

- Bribe payments (monetary and non-monetary).

- High-risk activities and practices.

- Automation of monitoring activities, alert and case management.

MAIN BENEFITS

Real-time detection of high-risk transactions

Monitor Plus ABC™ (Anti-Bribery & Corruption Manager) monitors and analyses operations in real time to identify those at high risk of bribery and corruption.

Risk control automation

The system reacts in real time through automated controls and deterrents to protect the institution against suspicious transactions, helping to prevent losses from this type of fraud and regulatory non-compliance.

Person risk management

Monitor Plus ABC™manages information from employees, suppliers, and third parties to detect errors and incomplete data, update data on an ongoing basis, expand general information, monitor information on related persons and expand key operative information. In addition, the system correlates events and assesses risk at the institutional level.

Accurate detection and low alert volume

Monitor Plus® uses an assembly of expert models and artificial intelligence to achieve high-level detection and minimal false positives, reducing customer friction and fostering loyalty. Additionally, a lower volume of alerts reduces the operational burden on staff.

End-to-end

Intelligent and automated management

Deterrence and automation

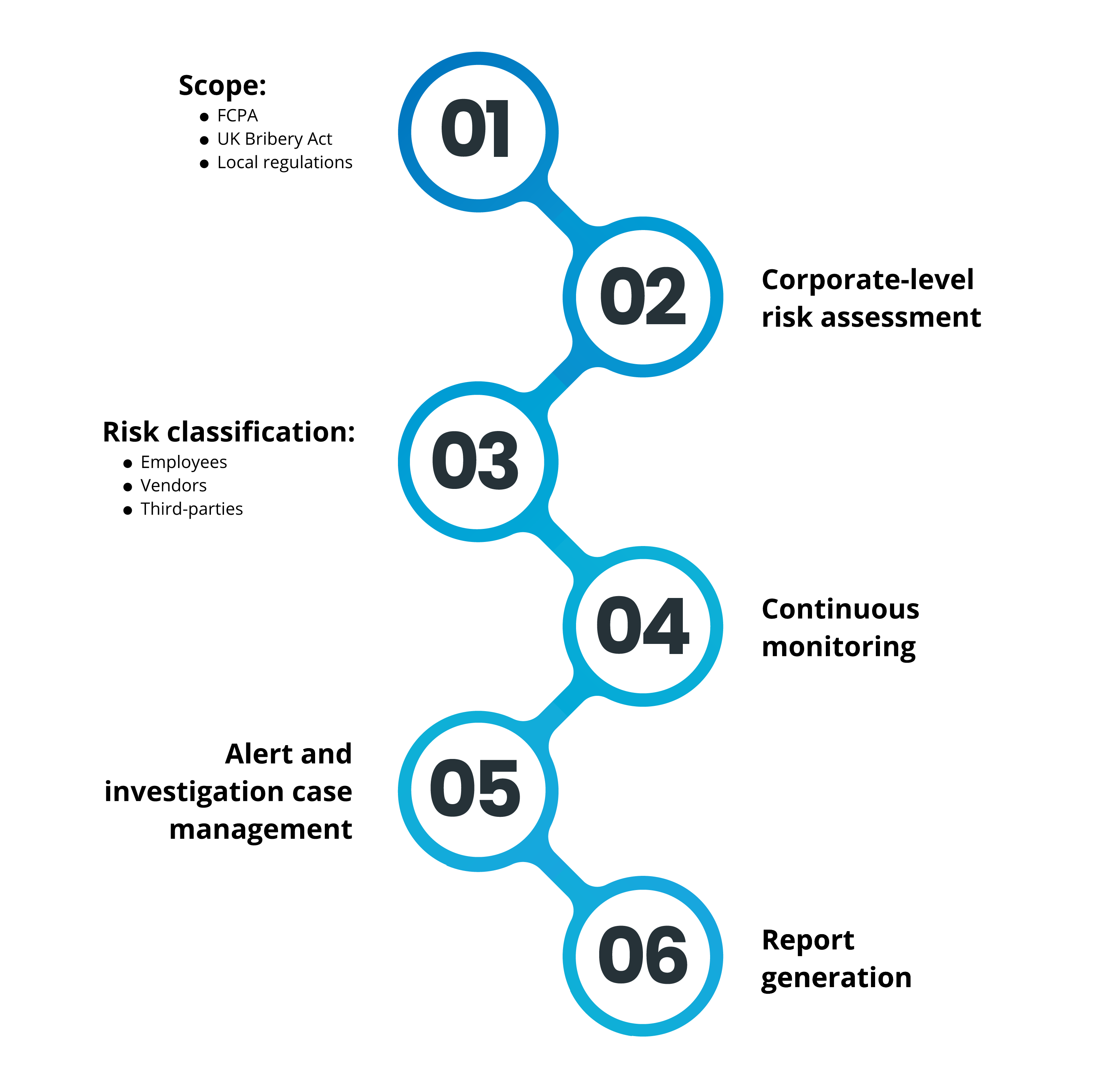

Monitor Plus ABC™ facilitates regulatory compliance, periodic assessment and implementation of anti-corruption and bribery controls and best practices. The system can implement deterrents to prevent internal fraud and corruption, as well as automate and facilitate due diligence processes to achieve an acceptable level of risk for the institution.

Integrated management

The system stimulates synergy between internal fraud prevention and anti-corruption efforts, complementing money laundering and compliance risk management and international regulations such as:

- US FCPA.

- UK Anti-Corruption Act

- Canada's CFPOA

- Chile's 20393 Bribery Law

- Colombia's 1474 Law

- Colombia's 1779 Law

- Wolfsberg Group Anti-Corruption Guide

DOWNLOAD BROCHURE

DOWNLOAD BROCHURE